Note: Placeholder holds Maker’s MKR.

Credit creation with skin in the game for all involved.

Credit has greased economic wheels for millennia, and Maker is the world’s first 100% software-based, community owned and operated credit facility. As a family of smart contracts operating on Ethereum, the system offers secured loans of equal cost to anyone in the world. The by-product of loan generation is dai, a stablecoin collateralized using on-chain rules and assets.

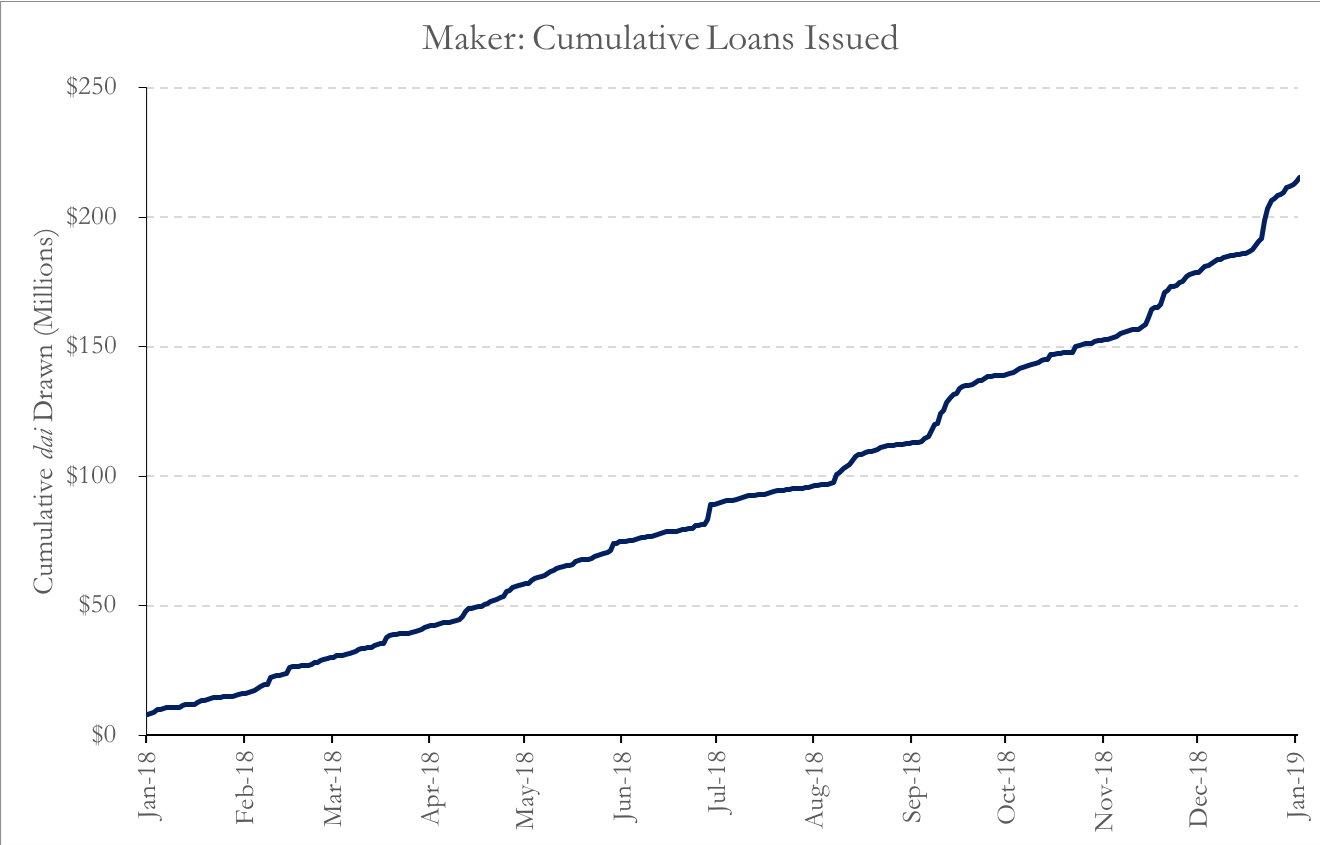

In its first year, Maker issued roughly $200 million in loans, with over $70 million currently outstanding (Figure 1). For some perspective, it took Lending Club five years to originate $250 million in loans [1].

Data from Digital Asset Research (DAR)

To get a loan, borrowers first lock ETH through an Ethereum transaction [2], creating a collateralized debt position (CDP). They are then able to issue themselves a dai-denominated loan against the posted collateral. The maximum amount of dai that users can issue themselves depends on the loan parameters set by MKR holders. Currently, the loan must remain under 2/3 the value of the locked collateral (i.e., $3 of collateral allows for $2 of dai to be issued to the borrower). The newly-created dai can then be exchanged for any of the assets it trades against (including BTC, ETH, USDC and USDT), which can be used to purchase other goods and services.

If the borrower’s collateral drops in value such that the loan outstanding becomes greater than 2/3 the value of the collateral (that is, if the loan becomes less than 150% collateralized [3]), then some of the borrower’s collateral is automatically sold to repurchase dai and partially pay down the loan. Self-interested agents called keepers do the work of enforcing this liquidation ratio, and in some months have made $200-300K in nearly risk-free profit from their efforts. The supply of dai expands as users create loans, and contracts as loans are paid down or liquidated.

Having principal at risk incentivizes borrowers to be responsible about their debts. Proper risk management combined with a lean protocol as the facilitator, instead of a profit-seeking company, leads to a lower cost of credit for all. The cost of a loan has ranged from 0.5% - 2.5% per year (called a stability fee), placing Maker’s credit facility at 1/10th the cost of secured loans offered by traditional financial institutions [4].

The stability fee must be paid with the second cryptoasset of the system, MKR, which is subsequently destroyed, making it a deflationary asset from its starting supply of 1,000,000 units. The more loans that are created and redeemed, the more MKR’s supply will deflate. This burning mechanism helps create token value similar to how equity buy-back programs can drive share prices in traditional companies.

But MKR holders don’t get something for nothing: they must govern the system by voting for the parameters around loans, such as collateralization ratios, types, and fees. While they stand to benefit from a MKR supply that deflates as loans are redeemed, they also stand to lose if any loan becomes undercollateralized. Should collateral values fall such that not enough value is left to cover the loan (i.e., the loan is less than 103% collateralized), then new MKR would automatically be created and sold in order to to buy back dai and pay down the toxic loan. MKR holders would then be diluted for having set parameters that allowed for such an event to occur.

The permissionless creation and circulation of dai positions it as an important unit of account within other decentralized finance applications. It is already being used by a rich ecosystem of centralized and decentralized applications, such as Ripio, Wyre, Compound and Nexo, with many more integrations in the works.

While there are valid concerns about the dangers of “permissionless credit creation,” MakerDAO’s auditable code & collateral and direct consequences for operators solves two principal-agent problems that have historically plagued the behavior of credit facilities.

First, credit facilities consistently run into trust issues due to the (relative) opacity of their operations and centrally held collateral. By contrast, if anyone is suspicious of Maker’s integrity, they can inspect all code (operations) and collateral of the system, anytime, anywhere. Transparency enables remediation before a crisis in confidence, making for a more resilient system.

Second, direct consequences for operators and holders of MKR disincentivize risky management. As we witnessed in the 2008 Financial Crisis, many of the actors that enabled an over-extension of credit were not directly punished for their actions, and many were even able to extract billions in bonuses from the government bailouts. In Maker, if the system fails, all capital holders are diluted equally, with no room to walk away enriched.

Maker’s open, low-fee service provides fair access to credit for everyone. Today, such access is only available to those already in the best financial position, while the rest are subject to wealth-eroding, high fee loans. Maker’s solution serves crypto-geeks and investors right now, but we believe is a critical step towards a more equal economic opportunity future.

For more on Maker, read our analyst report.

Footnotes:

[1] In a future report, we’ll share a full set of stats on Maker adoption. Some may object to the LendingClub comparison, which we agree is not apples to apples, but we provide it for perspective nonetheless.

[2] While ETH is currently the only collateral accepted, Maker is moving to a multi-collateral model soon.

[3] Some will complain that a 150% collateralization requirement is capital inefficient and will impede Maker’s broader adoption. As the volatility of cryptoassets drop, and more kinds of collateral can be used, the volatility of the value securing the loans will drop as well, allowing more capital efficient parameters to be set. Beyond these simple mechanics, the Maker team has a variety of other ideas for how to make the system more capital efficient over time. Right now, as one of the few venues where cryptoassets can be used as collateral for loans, Maker is not focused on optimizing, but instead enabling.

[4] As mentioned in Footnote 3, Maker loans are currently over-collateralized, which is a cost due to the time value of money. The other cost to keep in mind is if a loan becomes under-collateralized, the liquidation process incurs a 13% liquidation penalty.